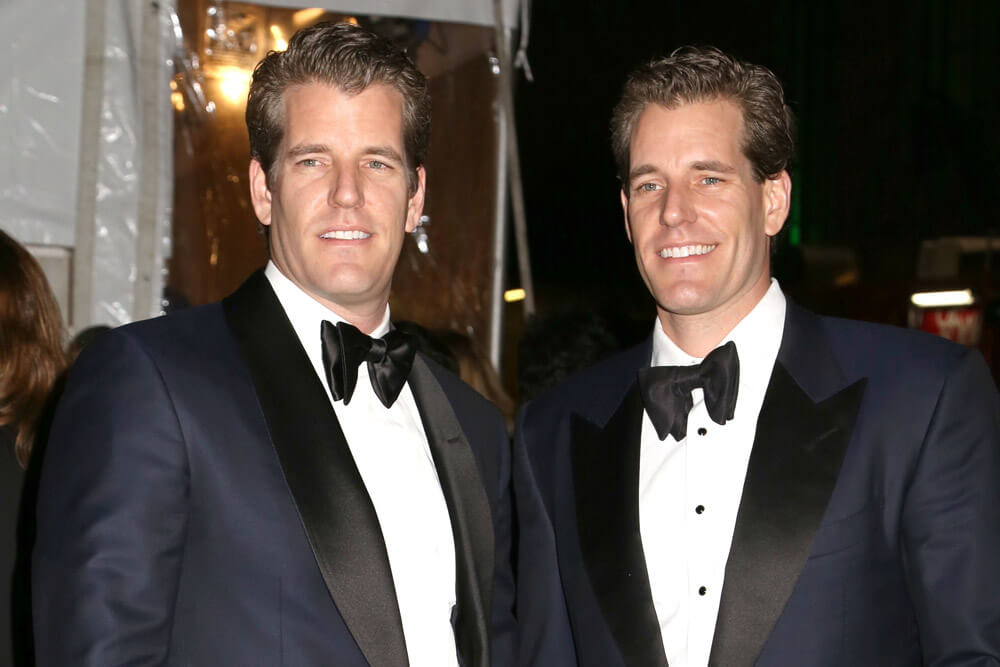

Cameron Winklevoss – one particular 50 percent of the Winklevoss Twins who run the Gemini cripto exchange in New York – is self-confident bitcoin is about to burst out of its shell and achieve a new bullish peak nobody is organized for.

Cameron Winklevoss on the Upcoming of BTC’s Selling price

At the stop of June, the rate of bitcoin rose past $31,000. This is the greatest bitcoin’s been all year, and definitely bigger than wherever it was for most of 2022, arguably the most bearish period on report for the world’s number a person digital moneda by market cap. Cameron Winklevoss believes that if persons are going to just take benefit of bitcoin still currently being considerably lower, they have to have to get associated now. In any other case, they are going to be paying a good deal far more for models. In an interview, he commented:

The terrific accumulation of bitcoin has started. Everyone looking at the flurry of ETF filings understands the window to order pre-IPO bitcoin prior to ETFs go live and open up the floodgates is closing fast.

The warning will come soon after BlackRock – one particular of the major fiscal expenditure firms in the earth – declared it was setting up to post a bitcoin-based trade-traded fund (ETF) software to the Securities and Trade Commission (SEC). The news came as a surprise to quite a few persons for a number of causes, a big a single becoming that in the extensive run, BlackRock is considered a classic finance enterprise, and lots of of these institutions will not go any where around cripto.

A further massive cause is that the SEC is going just after quite a few cripto providers ideal now, big ones like Binance and Coinbase. It’s develop into apparent that the SEC doesn’t treatment who gets victimized so lengthy as it can adhere to by on its agenda of getting rid of cripto from The united states and possessing full command.

However, several imagine that BlackRock could pave the way for a bitcoin-based ETF (something the SEC has long turned down) thanks to its substantial-position report with the fiscal agency. Consequently significantly, BlackRock has relished above 500 recognized proposals with the SEC and only just one rejection.

This New ETF Could Truly Pave the Way

Markus Thielen – head of research at Matrix Port – was rapid to agree with Cameron Winklevoss and thinks the bulls may perhaps return quicker than traders assume. Speaking about the new ETF, he commented:

Even though cripto continue to desires more than favorable macroeconomic tailwinds and institutional inflows into bitcoin, this is a welcoming improvement that reminds investors that cripto is listed here to stay. We can envision that this BlackRock iShares ‘commodity’ bitcoin ETF will catch the attention of an allocation in the range of around $20 billion to $50 billion more than time as ETFs that are concentrating on gold alone keep close to $100 billion. This BlackRock announcement has a superior probability of remaining authorised by the SEC and will push steady adoption from institutional investors for bitcoin.

Comments are off this post!